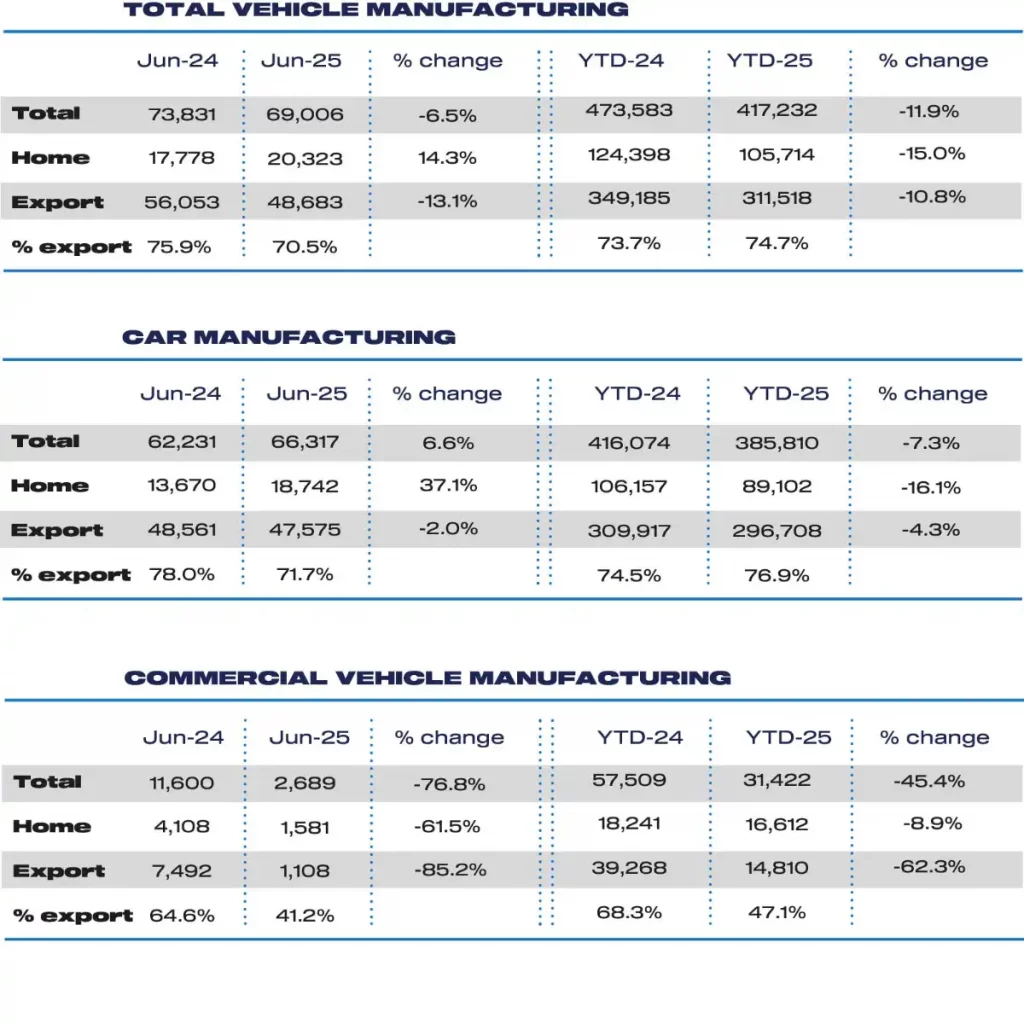

Figures released today by the Society of Motor Manufacturers and Traders (SMMT) reveal a significant downturn in UK new vehicle production during the first half of 2025.

Total output for the period fell by 11.9% to 417,232 units. The steepest decline was observed in the commercial vehicle sector, which experienced a 45.4% drop in volume to 31,422 units, in part due to the closure of the Vauxhall Luton plant.

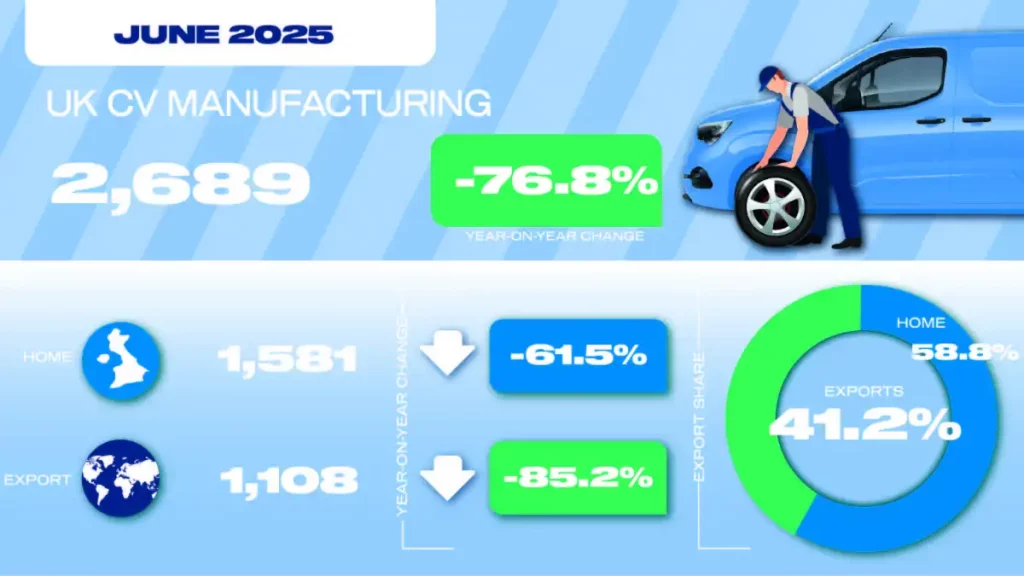

June 2025 proved particularly challenging for new van manufacturing, with just 2,689 units produced representing a dramatic 76.8% year-on-year decrease.

Both home and export markets were severely impacted. Production for the domestic market plummeted by 61.5% to 1,581 units, while exports saw an even sharper decline of 85.2% to just 1,108 units. As a result, the export share for commercial vehicles in June stood at 41.2%, significantly lower than the 64.6% recorded in June 2024.

The SMMT attributes this substantial fall in commercial vehicle output primarily to ongoing restructuring at production plants. This reorganisation has had a profound impact on output, contributing to the overall decline in the UK's vehicle manufacturing landscape.

While commercial vehicles faced a tough six months, the overall decline in UK vehicle production was softened by a 6.6% increase in car production in June.

However, this growth is set against a backdrop of subdued output in June 2024 due to model changeovers and supply chain disruptions.

Consequently, year-to-date car output still saw a 7.3% decrease, with 385,810 cars rolling off factory lines.

Despite the overall dip in car production, the manufacturing of electric cars showed resilience, rising by 1.8% to 160,107 units in the first half of the year. This marks a record share for electrified vehicles, with hybrid, plug-in hybrid and battery electric vehicles now accounting for more than two in five (41.5%) of all cars produced in the UK in 2025.

UK car production remains heavily geared towards exports, with 76.9% of year-to-date output destined for overseas markets. The EU continues to be the primary destination for UK car exports, holding a 54.4% share. The US follows with 15.9%, China at 7.5%, Turkey at 4.1% and Japan at 2.7%.

These five destinations collectively account for over 80% of overseas car sales.

Despite three consecutive months of declining export volumes, culminating in an 18.7% drop in June, the US maintained its position as the UK's largest single export market.