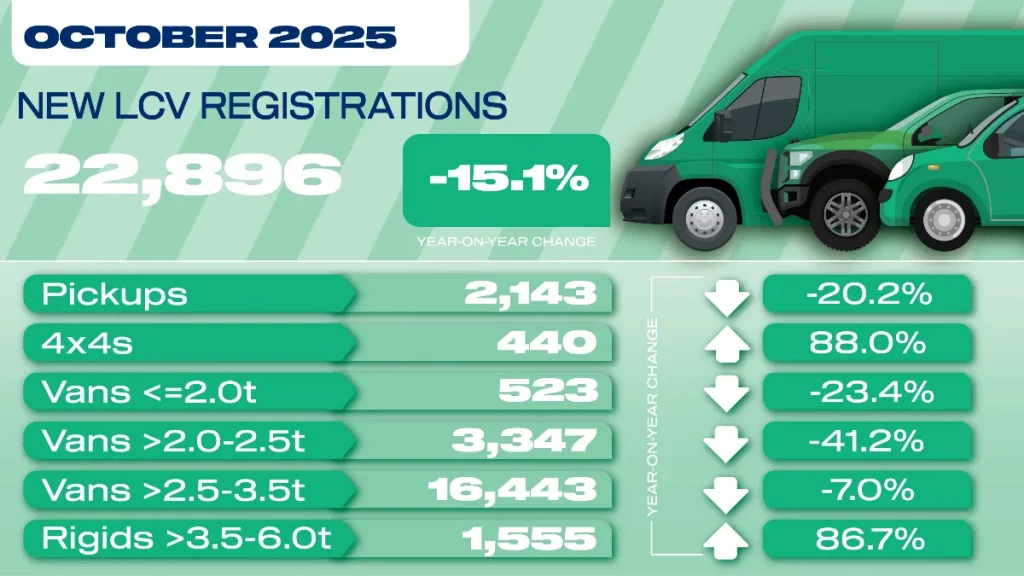

UK registrations of new light commercial vehicles (LCVs) dropped 15.1% in October to 22,896 units, according to the SMMT.

The decline follows a strong September and reflects softer fleet renewal through 2025 overall, with the market down 10.2% YTD to 264,160 registrations amid weak business confidence.

All main van segments fell in October. Large vans were down 7.0% to 16,443 (still 71.8% of the market); medium vans slid 41.2% to 3,347; and small vans fell 23.4% to 523. Pickups were 20.2% lower at 2,143, reflecting tax changes to double-cabs, while 4x4s grew 88.0% to 440 units.

Battery-electric vans posted their first monthly decline in 13 months, down 5.8% to 2,132 units. Because the overall market contracted faster, BEVs edged up to a 9.2% share. Even so, BEVs account for just 9.1% of 2025 registrations so far, well below the 16% mandated for this year (rising to 24% in 2026).

Year-to-date BEV volumes are still up 47.4% to 24,250 as new models reach showrooms.

The SMMT said faster charger rollout and swifter grid connections for depots are essential if operators are to meet targets.

Despite the October slowdown, the Ford Transit Custom continues to dominate the market, with the Ford Transit in second and the Ford Ranger leading the pickup field in third overall. The Mercedes-Benz Sprinter and Vauxhall Vivaro round out the top five, while the Renault Trafic, Peugeot Partner and Citroën Berlingo remain strong performers among fleets.

The SMMT’s outlook expects 321,000 new LCV registrations in 2025 (down 8.7% year on year), rising to 334,600 in 2026.

Zero-emission LCVs up to 3.5t are forecast to reach 9.7% share this year, growing to 14% in 2026.

| Rank | Model | Registrations YTD |

| 1 | Ford Transit Custom | 42,295 |

| 2 | Ford Transit | 25,431 |

| 3 | Ford Ranger | 15,509 |

| 4 | Mercedes-Benz Sprinter | 11,551 |

| 5 | Vauxhall Vivaro | 10,759 |

| 6 | Renault Trafic | 9,905 |

| 7 | Peugeot Partner | 9,051 |

| 8 | Toyota Hilux | 8,441 |

| 9 | Citroën Berlingo | 8,069 |

| 10 | Volkswagen Crafter | 7,890 |