Tax for pick-up trucks is changing but there's more than one kind of tax to be aware of.

If you've already read our article on the tax you must pay for a van then you'll undersand the road tax implications. Broadly speaking those same fees for road tax are due for pick-up trucks as well.

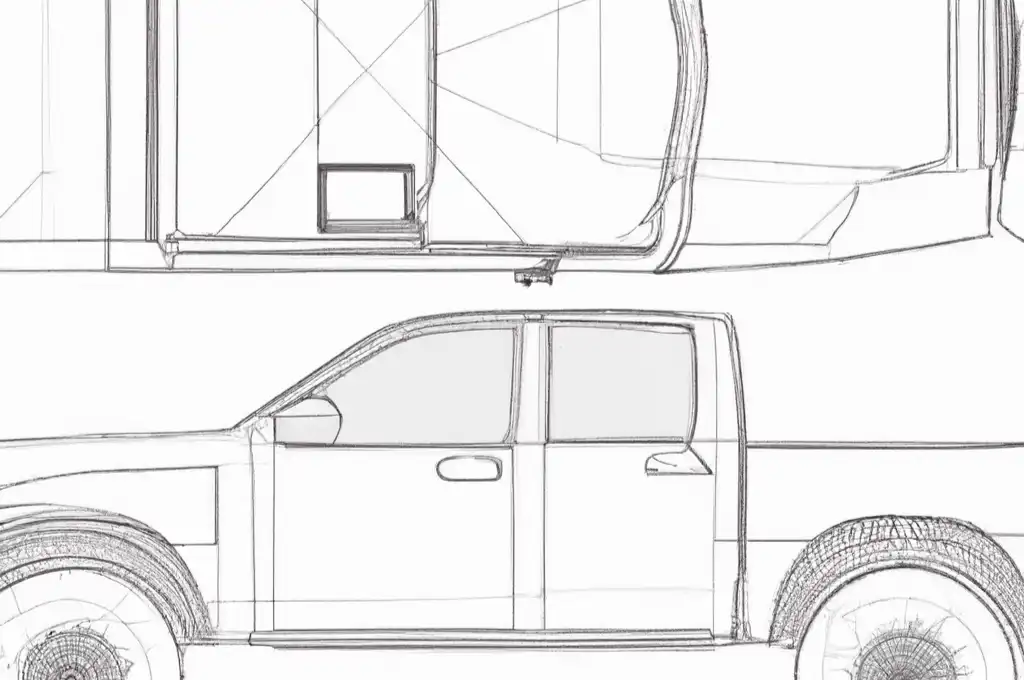

As a commercial vehicle, the road tax for pick-up trucks is a flat rate. In order for it to be considered a commercial vehicle the rules in the UK dictate that a pick-up truck must be able to carry a payload of 1000kg - or 1045kg if it has an enclosed loadspace.

Road tax for light good vehicles under 3.5-tonnes is currently set at £320 per year. That's the annual fee you'll pay for having the pick-up truck on the road. If you're a private owner that's the only real tax obligation you will have to pay.

However, here's where it gets complicated. If you own your pick-up truck through a company - ie. you have it on a lease through a business or you have bought it outright as a Limited company - then you may have to pay an additional tax.

This additional tax is known as a Benefit In Kind (BIK). You pay BIK on a vehicle if you are using it for personal use - that includes commuting to work. If you simply have a work vehicle and you only use it to for work purposes - a farm pick-up truck used to move hay or livestock around could be an example of this - then this doesn't apply.

If though, you have bought a pick-up truck as a company vehicle to avoid paying more tax than you would than say having a conventional car or 4x4, then you're now in the government crosshairs.

From 1 July 2024 all pick-up trucks that are company cars and used for personal use, will now no longer be classed as commercial vehicles. Pick-up trucks will instead be taxed as company cars and subject to the normal amount of company car tax you have to pay for a car.

In the case of a pick-up truck - most of which have large engines and therefore fall into the top band of company car tax (which is based on CO2 emissions) - then you'll be paying 37% of the taxable value of the vehicle. Simply put, if your pick-up truck costs £50,000 then the taxable value is £18,500.

If you pay tax at 20% you will pay 20% of that taxable value - £3700 - per year in tax. If you pay tax at a 40% rate then you will pay £7400. That's a huge difference from the previous arrangement which for the 2023/2024 tax year was flat rated at a taxable value of £3920.

UPDATE: 19/02/24

The Government has U-turned on its decision to tax double-cab pick-up trucks in the same way as passenger cars. Pick-up trucks with a second row of seats will continue to be treated as commercial vehicles when they meant the 1000kg payload requirement.