Home »

Stellantis electric van production site could be at risk, according to Stellantis UK group MD, Maria Grazia Davino.

Ellesmere Port is currently an electrification hub for production of the Citroen E-Berlingo, Fiat E-Doblo, Peugeot E-Partner and Vauxhall Combo Electric.

Speaking at the Society of Motor Manufacturers and Traders (SMMT) annual summit, Davino said the site near Liverpool as well as Vauxhall’s factory in Luton could be in jeopardy if more wasn’t done by government to increase demand for zero emission vehicles.

The decision to halt production at one or both sites could come as soon as a year.

Davino said: “Stellantis UK does not stop, but Stellantis production in the UK could stop.”

Electric van production is due to start in Luton next year when it will make the medium sized electric vans in the group which include the Citroen E-Dispatch, Fiat E-Scudo, Peugeot E-Expert and Vauxhall Vivaro Electric.

“We have undertaken big investments in Ellesmere Port and in Luton, with more to come. If this market becomes hostile to us, we will enter an evaluation for producing elsewhere,” Davino explained.

The UK government has set a goal to ban sales of new petrol and diesel cars by 2035 - initially their plan was to introduce the ban in 2030.

With all parties currently on the campaign trail ahead of the 4 July general election, key climate change messages and how future governments will tackle them have become an important manifesto element.

Increasing threats from the EU to impose tariffs on Chinese built vehicles is also causing unrest in the industry.

After an EU indication that costly tariffs could be imposed on Chinese manufacturers - that would include Maxus and models including the recently launched Maxus eDeliver 5 and Maxus eDeliver 7 - several European manufacturers chastised the idea, including global Stellantis boss Carlos Tavares.

The Ram ProMaster is the North American version of the large Stellantis cargo van with a towing capacity to rival the largest of pick-up trucks.

You may think of it as just being a cargo van, but large vans are capable of towing a lot more than you might think. You can check out how much its rivals can tow with our guides to the other large vans where you'll find the Ford Transit towing capacity and the Mercedes-Benz Sprinter towing capacity.

This, though, is the ultimate guide to the Ram ProMaster towing capacity which as well as telling you how much a Ram ProMaster can tow, will also cover how to tow using a ProMaster cargo van.

This guide is applicable to the current generation of the US/North American Ram ProMaster cargo van, launched in 2008 after the Dodge Sprinter was dropped from the market.

Its essentially the only Ram van that has been on sale, and although the Dodge badge appears on the ProMaster, the cargo van is very different to any of the Dodge badged vans from the past.

The Ram ProMaster cargo van towing capacity depends on the size of the cargo van you have, but to make it simple for you, the ProMaster cargo van range has a capacity from 5100 lbs to 6910lbs for its maximum towing ability.

The total trailer weight rating of the Ram ProMaster depends on which GVWR version you have, the smaller ProMaster 1500 towing capacity is larger than that of its larger siblings the ProMaster 2500 and ProMaster 3500.

We'll break down the individual towing ratings for each of the Ram ProMaster GVWRs in the next sections.

Although the Ram Promaster 1500 is the smallest cargo van in the line-up, it offers the best towing capacity. This is because the Ram vans are all rated to the same towing maximum but the amount they can tow is determined by their own kerbweight.

The smallest Ram 1500 ProMaster Cargo Low Roof with an 118-inch wheelbase is the smallest model in the range and therefore gets the largest towing capacity of 6,910lbs.

Increasing the wheelbase length from 118-inches to 136-inches adds more weight which reduces the max towing capacity to 6,800lbs. Similarly adding a high roof to the same 136-inch chassis drops the towing capacity another 100lbs to 6,700lbs.

| Ram ProMaster 1500 | Towing Capacity (Lbs) |

|---|---|

| RAM 1500 PROMASTER Cargo Low Roof 118" Wheelbase | 6910 |

| RAM 1500 PROMASTER Cargo Low Roof 136" Wheelbase | 6800 |

| RAM 1500 PROMASTER Cargo High Roof 136" Wheelbase | 6700 |

While the higher GVWR number for the Ram ProMaster improves payload, it doesn't have a positive affect on the towing capacity.

That means that the ProMaster 2500 has a very similar max towing ability to the smaller and larger models and is based purely on the wheelbase and therefore kerbweight of the cargo van.

The Ram Promaster 2500 with the largest maximum towing ability is the 136-inch low roof model which has a maxmimum towing capacity of 6,800lbs.

There's a longer wheelbase measuring 159-inches which reduced the towing capacity to 6,480 lbs which is the same whether it is a cargo van or a windowed van - both of which come with high roofs.

All Ram ProMaster 2500s have a GCWR of 12,000 pounds.

| Ram ProMaster 2500 | Towing Capacity (Lbs) |

|---|---|

| RAM 2500 PROMASTER Cargo Low Roof 136" Wheelbase | 6800 |

| RAM 2500 PROMASTER Cargo High Roof 136" Wheelbase | 6700 |

| RAM 2500 PROMASTER Cargo High Roof 159" Wheelbase | 6480 |

| RAM 2500 PROMASTER Window High Roof 159" Wheelbase | 6480 |

You might be thinking that as the biggest van in the range the Ram ProMaster 3500 towing capacity would also be the largest, but that's not the case.

The maximum towing capacity of the Ram ProMaster 3500 is 6,700 for the low roof 136-inch wheelbase model.

All ProMaster 3500 chassis cabs have a towing capacity of 5,100 lbs.

| Ram ProMaster 3500 | Towing Capacity (Lbs) |

|---|---|

| RAM 3500 PROMASTER Chassis Cab Low Roof 136" Wheelbase | 5100 |

| RAM 3500 PROMASTER Chassis Cab Low Roof 159" Wheelbase | 5100 |

| RAM 3500 PROMASTER Chassis Cab Low Roof 159" Wheelbase Extended | 5100 |

| RAM 3500 PROMASTER Cargo Low Roof 136" Wheelbase | 6,700 |

| RAM 3500 PROMASTER Cargo High Roof 159" Wheelbase | 6,600 |

| RAM 3500 PROMASTER Cargo High Roof 159" Wheelbase | 6,480 |

| RAM 3500 PROMASTER Cargo High Roof 159" Wheelbase Extended OH | 6,410 |

| RAM 3500 Promaster Window High Roof 159" Wheelbase Extended OH | 6,410 |

| RAM 3500 PROMASTER Cut-Away Low Roof 136" Wheelbase | 5,100 |

| RAM 3500 PROMASTER Cut-Away Low Roof 159" Wheelbase | 5,100 |

| RAM 3500 PROMASTER Cut-Away Low Roof 159" Wheelbase extended | 5,100 |

That will be the RAM 1500 ProMaster Cargo Low Roof with a 118" Wheelbase 1L11 H1 height. It has a towing capacity of 6910lbs and a GCWR of 12,000lbs.

The next best model for towing is the RAM 1500 ProMaster Cargo Low Roof 136" Wheelbase 1L12 H1 which has a 6,800lbs towing capacity. The RAM 2500 ProMaster Cargo Low Roof 136" Wheelbase 2L12 H1 also has a 6,800 pound towing capacity.

As well as knowing how much you can tow, you'll also need to know how to tow it. That's why you need to know where the tow hitch or towing eye is located on the Ram ProMaster.

The towing eye is screwed into the front of the cargo van to give a solid spot from which to tie a rope or chain. This then means that the van can be towed out if stuck.

The Ram ProMaster tow hook is located with the tyre jack which can usually be found under the front passenger seat.

The location for the eye to be screwed into the front bumper of the van is behind a small plastic cover to the side of the numberplate.

Simply pop the cover off and screw the Ram ProMaster towing hitch into the hole untill it is firmly secured.

Remember to remove the towing eye once you have finished towing. It is illegal to leave a towing eye in position as it is a protruding item from the front of the vehicle that could cause serious harm to other road users.

The two vans are pretty closely matched but the Mercedes Sprinter has a slightly larger towing capacity.

As you've already found out, the Ram ProMaster is capable of towing up to 6910 lbs whereas the Sprinter can tow 7716 lbs.

The Ford Transit can also tow a maximum of 7716 lbs, this is the best towing capacity for a light van.

The Ram ProMaster is produced by Stellantis, which is a combination of the Fiat-Chrysler brands and PSA Peugeot-Citroen.

The Ram ProMaster is made at the Saltillo van production site in Mexico in the Coahuila region. The area is home to a large amount of automotive production and produces commercial vehicles for Stellantis to export to the United States.

It may sounds like a simple question to ask who owns Peugeot, but as one of Europe's oldest car manufacturers there are lots of interesting facts associated with the history of Peugeot ownership.

Answer the question....

The current owner of Peugeot is Stellantis, the combined company of PSA Group and Fiat Chrysler Automobiles created on 16 January 2021.

If you want to know more about the owners of Peugeot, then there's a seperate article all about this new global automotive powerhouse, called Who is Stellantis? in our advice section.

The Peugeot name is steeped in history. Life began making coffee grinders and bicycles, using the family expertise in making cog-based items the natural step was to bring that knowhow into gears for a car. In 1896 Armand Peugeot branched out from the family business to set up a new car company with the same name. The rest, as they say, is history, as Peugeot Cars became a roaring success

Peugeot grew into one of the largest car manufacturers riding out storm of two world wars to become France's best-loved manufacturer.

Peopele often get confused about the nature of how Peugeot and Citroen became a duo.

The marriage between France's two biggest auto makers happened in December 1974 when Peugeot bought a 38.2% share of Citroen.

Less than two years later, in April 1976 they took a controlling stake of 89.95% when Citroen went bankrupt.

This brought about the formation of PSA Group, which is short for Peugeot Société Anonyme. Henceforth, and up until the merger with Fiat Chrysler it was then known as PSA Peugeot Citroën.

The first Peugeot van dates back to the time of the formation of the Peugeot automotive business with the Type 13 delivery van, offering a 500kg payload and a motorised alternative to a horse and cart.

After WW1 the Peugeot van range began on its path towards the vans we know and love today with its first "car-derived" van - that's to say it was a car with no back seats and therfore suitable for carrying load items.

Later pre-war models took on the appearance of a pick-up truck with a flat load bed and boxy cabin for two occupants.

It was only after WW2 that the typical van dimensions started to take shape with the first front-wheel-drive panel vans. The D3A became the D4, the D7 and then then J7 and J9.

Into the 80s and the Peugeot model names that we now associate with their range started to appear. The Peugeot Boxer made its first apperance, offering a considerable upgrade in carrying capacity over the previous vans. It's also where the association with co-developed Citroen vans began as the two companies shared this new model, known as the Sevel van ((Société Européenne de Véhicules Légers SA and Società Europea Veicoli Leggeri-Sevel S.p.A.) because of its partnership with Fiat.

Stellantis ProOne’s new hydrogen large van will come in right-hand-drive as early as next year.

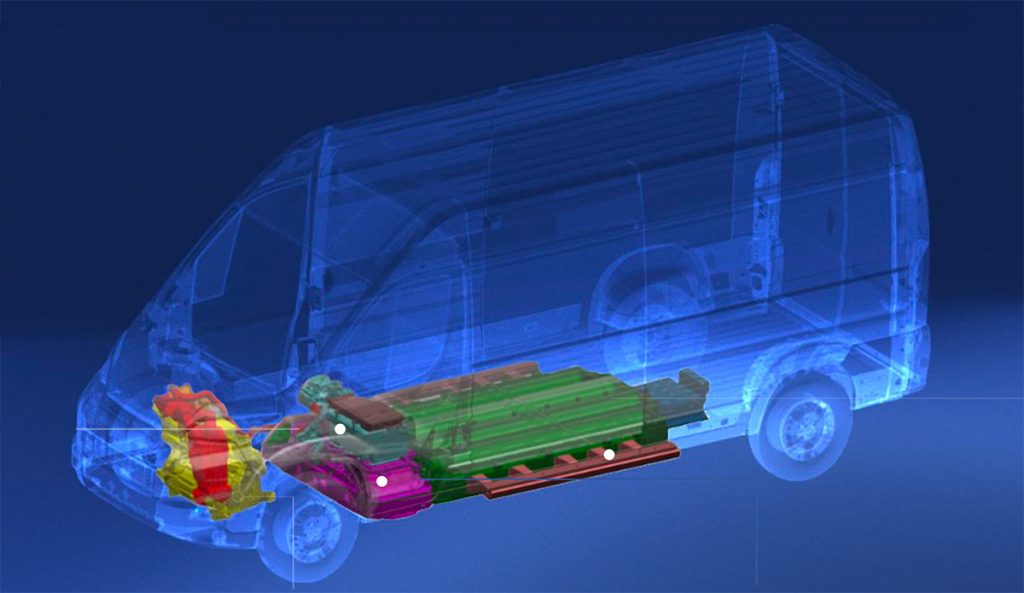

Unlike the mid-sized version of their hydrogen fuelled van – currently available in France and Germany as the Vauxhall Vivaro-e Hydrogen – the large van will be based off the Citroen E-Relay, Fiat E-Ducato, Peugeot E-Boxer and Vauxhall Movano Electric battery electric vans. It uses a combination of a 110kW motor paired to a 45kW fuel cell with an 10.5kWh battery pack.

Hydrogen storage is from four vessels providing a total of 7kg of usable H2 and an expected range of more than 500km.

In comparison, the mid-sized van uses three vessels to give the van a 400km range.

The van will be available in L3H2 and L4H3 sizes giving a total loadspace of 13m3 and 17m3 as well as a 1,300kg payload.

The large van can be fuelled at 700 Bar enabling a fill-up time of less than five minutes.

Stellantis’ decision to increase their efforts into hydrogen products are reflected in the EU Council’s decision to create the Alternative Fuels Infrastructure Regulations (AFIR). All EU countries will be required to deliver a viable hydrogen refuelling network with one 700 Bar hydrogen station located every 200km on all main corridor routes. They will also have to have 1 station for each assigned urban node in order to aid refuelling in cities. EU countries will need to have completed the network by 2030 which should create more than 500 filling stations across the EU member states.

Currently there are around 150 public H2 filling stations with the majority in Germany, France, Netherlands and Switzerland.

While the mid-sized H2 van is scheduled to be rolled out to more European countries this year, including Netherlands and Belgium, a right-hand-drive version for the UK will not come until the next generation of medium sized vans is introduced in several years time. Instead, the large van will be rolled out across Europe and to North America after 2025 when a hydrogen fuelled pick-up truck – under the RAM brand – will also be brought to market.

In a major boost for the town, Luton will begin production of new electric models next year for the entire range of Stellantis medium vans sold in the UK.

The plant will mostly be producing right-hand-drive versions of the Stellantis range of vans that include the Vauxhall Vivaro Electric, Peugeot E-Expert, Citroën ë-Dispatch and Fiat Professional E-Scudo. However, the site will also be used to produce some left-hand-drive versions of the same models for export as well as the Opel Vivaro Electric.

Production will begin in the first half of 2025 in limited numbers, and the electric vans will be produced alongside their internal combustion engine counterparts.

Luton joins Ellesmere Port as the second electric model manufacturing site for Stellantis vans in the UK.

Ellesmere Port was announced as the manufacturing site for all versions of the Citroen e-Berlingo, Peugeot e-Partner, Fiat e-Doblo and Vauxhall Combo Electric in September last year, following a £100m investment to transform the plant for EV production. It is also became the first Stellantis plant globally to be dedicated to electric vehicle manufacturing.

Stellantis is currently the best-selling van manufacturer in Europe with a 30.4% market share in 2023. Their electric vehicles also have a 38.8% of the European market, while in the UK that figure rises to 47.9%. Vauxhall was the best-selling electric van manufacturer with 6,402 sales out of Stellantis' total UK sales of 10,272 vans. The majority of Vauxhall's electric van sales were for the Vivaro Electric as the number one electric van in the UK.

Vauxhall's Luton plant began life in 1905 and have been producing the Vivaro van since 2001. When Stellantis acquired Vauxhall and production was switched over from producing Renault-based vans to the Peugeot-Citroen model, the plant also took on group production of medium-sized vans, adding the Fiat Scudo in 2022.

Mark Noble, Luton Plant Director & Stellantis UK Manufacturing Lead, said: “Following the transformation of our Ellesmere Port facility to produce all-electric compact vans, I’m pleased to announce that we will commence limited production of our medium electric van in Luton from next year, when the first customer vehicles will roll off the production line. This is a fitting way to mark Luton’s 120th anniversary.”

Luton produced more than 90,000 vans last year, all of which were ICE models.

Estimates vary but more than two thirds of the world’s populations will be living in cities by 2050 – an increase of 13%, equating to roughly 1bn more people. As things stand, this poses a number of issues not least for air quality and noise pollution as scores of vehicles flood the cities to meet our needs whether it is for construction materials and equipment or goods for home delivery and healthcare.

While much of the urban population growth is expected in countries such as India, China and Nigeria, Europe and the UK are reacting to the role transport plays in pollution levels and are introducing stricter emission targets in cities and placing restrictions on the types of vehicles that will be allowed to enter the cities to counteract the rise.

Electrification is becoming a high priority for governments and fleets alike, but how will building materials, your weekly food shop and critical temperature vaccines all be moved about the urban environment. There’s now a growing need for converted electrified vehicles capable of moving such items and just like with combustion engine products it will be chassis cab vans from bodybuilders that will be filling the void.

“We’re constantly electrifying our vans, and we always keep an eye on our customer requirements. The requirements regarding bodies and conversion are as diverse as the sectors that use them,” explains Markus Reis, Mercedes-Benz Vans product manager.

While there are no limitations as to where an electric vehicle might be used and what sectors are likely to operate them first, blue chip companies are leading the way and it’s no surprise that the booming home delivery segment is a willing customer.

“We have both N1 and N2 vans of the E Deliver 9 being built for Tesco,” explains Mark Barrett, MAXUS general manager. Having already supplied chassis cab versions of its previous generation large electric van, the EV80, to a number of fleets, MAXUS has been able to develop their new E Deliver 9 model to better cope with the demands imposed by fridge units, tail lifts and other auxiliary equipment.

“One of the things for us, is the early planning with the customer at how we integrate the fridge and the base vehicle together. We engage with the factory, and we have 3kW to 5kW of additional spare power from the battery which is going through a controller unit, and the fridge connects to that. For other auxiliary equipment, like tail lifts, it can come from the standard 12v battery,” explains Barrett.

Not all manufacturers will permit a direct power feed from the traction battery, which can lead to having separate power supplies in addition to the 12v battery to run ancillary devices, however, for the most part the power consumption of the equipment is either relatively low, or confined to short bursts.

“Of course it impacts on the range,” continues Barrett, “but surprisingly very little. On maximum drawdown you’re looking at 10 to 15 minutes to get it down to chill or frozen. That will probably done while still on charge and once its down to temperature it doesn’t take much [to maintain the temperature]. Heating the cabin of the van will in theory use more van than the fridge.”

Veteran of the electric light commercial vehicle market Renault, whose Master ZE large van has recently been rebranded as the Renault Master E-Tech, already has an electric Luton low-loader van on sale and is, according to Renault LCV conversions manager Mark Waite, experimenting with other prototype bodies and battery top-up solutions.

“The only complexity we have with electric vehicles is how you treat electrical connections because it’s forbidden to take any electrical connections off of the Master’s traction battery. You still have the 12v electrical system to connect to, so the question is when do you connect to that [or a separate supply]. We’ve prototyped a ZE tipper and will go into a test phase to see what impact it has on range. We’re not expecting it to have a dramatic effect because the electrical draw for raising a tipper bed happens for a 20-second blast. Putting a tail lift on a Luton box van, you’ve got the same issue where the electrical draw would impact the range of the vehicle. In that instance, we’re doing a trial with fitting solar panels to the roof to assist in making sure the main 12v battery is topped up, because in reality you’re going to use a tail lift more than a tipper.”

Manufacturers are in fact already working on a solution for more power-hungry equipment with both Iveco and the Stellantis brands confirming to Van Reviewer that they are working on electric PTO solutions for their eLCVs.

“We’ve been working with bodybuilders for about two years,” says Mike Cutts, Iveco business line director (LCV) about the 2022 model-year electric Daily van.

“We will focus on the chassis models with an electric PTO offer, making sure there’s enough transferable power to meet the applications whatever you want to put on the back,” Cutts explains.

Presently, however, Stellantis bodybuilder relations manager, Hervé Criquy, believes that the vehicle’s main battery can be used to power most equipment and with only a small decrease in range from the equipment’s power draw. “We believe the HV (high voltage) battery can supply enough power to any conversion appliance, without major impact on the range due to the consumption. For example with fridge solutions, the impact of a normal delivery round trip shall be of -5 to -8% on the range,” Criquy says.

When it comes to limitations on what body can be applied to an electric van both Barrett and Waite believe there are actually no limits. With the exception of the placement of battery cells if they’re located within areas a bodybuilder would want to drill in to for mounting, neither sees any issues – a point which Mercedes has ably demonstrated by converting an ambulance on to an Mercedes-Benz eSprinter chassis.

“The industry is quite good at thinking how to overcome potential drawbacks with electric systems. If you think of refrigerated vehicles, the refrigerated vehicle industry has developed its own lithium-ion battery systems to power electrical refrigeration units,” Waite says.

Barrett agrees, and goes so far as to say that electric versions can outperform their diesel equivalents.

“I think any of the applications on a diesel would work on electric. Even when it comes to van payloads as we have that flexibility in the UK with the uprated payload. It has killed that issue. We’re plated at 4050kg on the N2, so you’ve actually got a better payload.”

Vehicle range, reduced payload and invariably the purchase cost may all be valid areas of concern for potential electric van purchasers, but when it comes to equipping this new era of vehicles with the bodies and equipment we’ve become accustomed to there’s no reason to be alarmed. Indeed, as technology improves, the efficiency and productivity of these vans may well see bodied EVs becoming more practical and cheaper to run than their ICE equivalents.

How to build onto an electric van chassis

Like with any build its best to read the instructions. Manufacturers provide their partners with details technical documents and these should be your first port of call. An accredited body builder is best placed to do the work. If in doubt, consult the experts.

The priority is to not damage the safety cell of the vehicle or its battery. Many electric vehicles have defined points where bodies, cranes or tail lifts can be fixed to. These will likely be the same position as any ICE equivalent vehicle.

If adding additional powered equipment don't assume you can use the van's own electrical system. Some vans will make provisions for you to tap into an electricity supply, other won't. More power hungry devices might require a Power Take Off unit and ePTOs are becoming increasingly common.